Ditch the Drywall

Why Modular Pods Are the Smartest Real Estate Asset in 2026

01 The Strategic Shift: From “Office Amenity” to Financial Asset

For years, office meeting pods were framed as a nice-to-have acoustic solution—something to quiet open offices or add privacy on demand. In 2026, that framing is outdated.

In high-cost, high-friction markets like Miami, modular office pods have evolved into something far more strategic: a flexible real estate asset that preserves capital, accelerates occupancy, and reduces risk.

If you oversee real estate, finance, or facilities, the more relevant question is no longer “Do pods work?” but:

“Why would we ever sink capital into drywall again?”

02 Asset vs. Sunk Cost: The Real ROI Conversation

Traditional Tenant Improvements (TI): A One-Way Expense

Drywall construction is a classic sunk cost:

- Permanently attached to the building.

- Fully abandoned at lease end.

- No resale value.

- No portability.

- No flexibility if headcount or layout changes.

In Miami’s Class A and B office market, TI costs routinely run $80–$150+ per square foot, and that investment disappears the moment you hand back the keys.

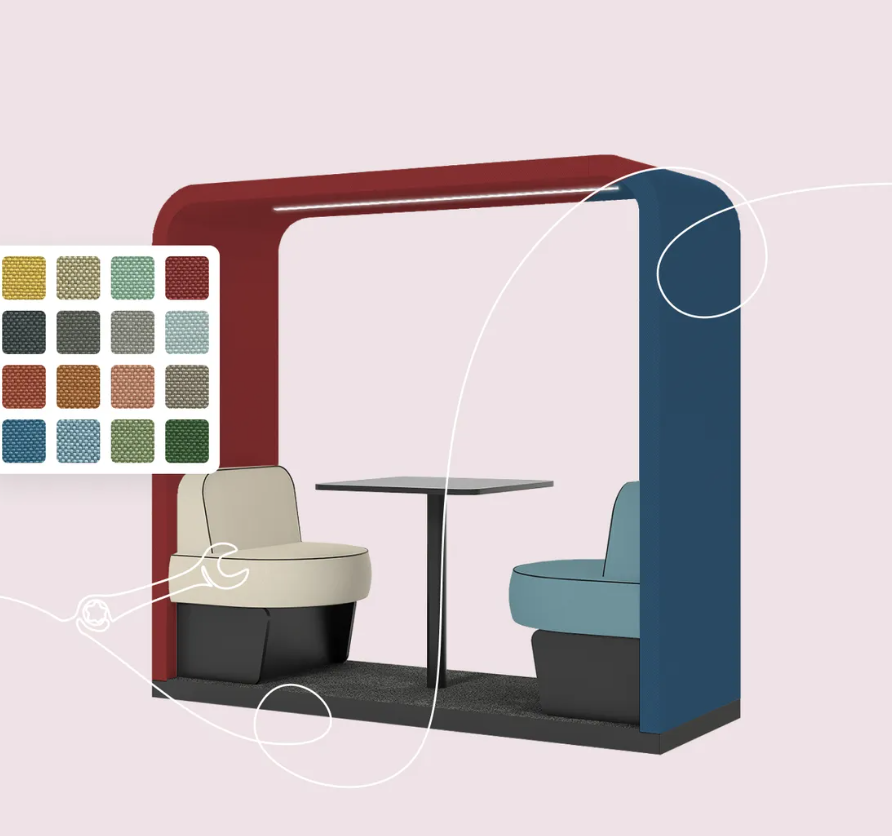

Modular Office Pods: Capital That Moves With You

Office meeting pods, by contrast, behave like furniture assets:

- Portable and reusable.

- Can move to a new office or satellite location.

- Can be reconfigured as teams grow or shrink.

- Retain residual value.

- Can be sold, redeployed, or repurposed.

Financial Reframe: Pods aren’t an expense, they’re capital preservation in an uncertain lease environment.

03 Bypassing the Miami Permit Trap

The Reality of Miami-Dade Construction: Anyone who has built in Miami knows the bottleneck: 3–6 month permitting timelines, revisions, resubmittals, inspections, and carrying rent while construction stalls. For growing companies, those delays aren’t just inconvenient, they’re expensive.

Why Modular Pods Win: Most office meeting pods do not require permits, avoid inspections and trade coordination, and install under furniture rules, not construction codes. Result: You bypass one of the most unpredictable cost and timeline risks in Miami commercial real estate.

04 Speed to Value: Weeks of Dust vs. 4 Hours to Productivity

Drywall Reality: Traditional buildouts mean weeks of noise, dust, and disruption. Trades stacking delays, lost productivity, and employees working around construction.

Modular Pod Reality: Modern pods deliver pre-fabricated and assemble in as little as 4 hours. They offer plug-and-play power and ventilation with zero downtime for adjacent teams.

Operational ROI: The faster a space becomes usable, the faster it generates value. Pods compress time-to-productivity from months to hours.

05 Tax & Accounting Advantages CFOs Care About

While specifics vary by accounting strategy, pods often receive more favorable treatment than permanent improvements.

Typical Advantages (Consult Your CPA):

- Classified as furniture or equipment, not building improvements.

- Potential for accelerated depreciation.

- Clear asset schedules.

- Easier write-offs if relocated or sold.

Strategic Insight: Drywall locks capital into the landlord’s asset. Pods keep it on your balance sheet.

06 Flexibility Is the New Hedge

In 2026, flexibility isn’t a design preference, it’s a risk management strategy. Pods allow companies to scale without re-building, test layouts before committing, support hybrid models, and react to lease changes without penalties. In volatile markets, fixed construction is a liability. Modular infrastructure is optionality

The Bottom Line for COOs, CFOs & Facility Leaders

If you’re optimizing real estate spend in Miami, the comparison is clear:

| Factor | Drywall Construction | Modular Office Pods |

|---|---|---|

| Permits | Required | Typically avoided |

| Timeline | 2–6+ months | Same day |

| Capital Treatment | Sunk cost | Moveable asset |

| Lease-End Value | $0 | Retained |

| Flexibility | None | High |

| Operational Disruption | Significant | Minimal |

Final Takeaway

Office meeting pods are no longer an acoustic solution, they’re a strategic real estate decision. In a market where time, capital, and flexibility matter more than ever, the smartest companies aren’t building walls. They’re buying assets that move with them.